The digital money market (Cryptocurrency) wound up in a condition of mindful good faith on June 28 get-togethers’ (BTC) cost momentarily spiked above $35,500, recharging trusts that the bull pattern will continue in a matter of seconds.

In spite of the bullish move, a few examiners have cautioned that the inability to get an everyday close over the $35,000 opposition might be an indication that dealers are just shutting positions at every breakout to obstruction, a touch that further drawback maybe future.

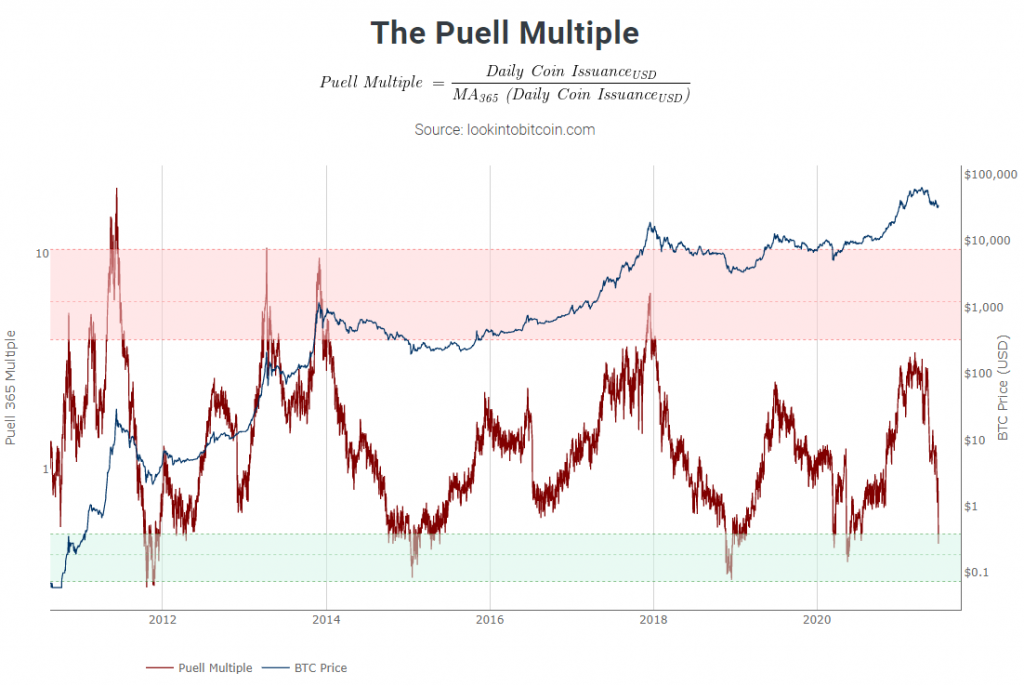

As per David Pull, on-chain expert and maker of the Pull Multiple, the pointer has quite recently given its fifth Bitcoin purchase signal ever.

The Pull Multiple spotlights the inventory side of the Bitcoin economy, chiefly Bitcoin excavators and their income, and investigates market cycles from a mining income viewpoint.

It is determined by separating the day-by-day issuance worth of BTC (in USD) by the 365-day moving normal of everyday issuance esteem.

The Pull Multiple condition and chronicled execution. Source: LookIntoBitcoin.com

As seen on the diagram over, the marker estimates periods where the day-by-day worth of the Bitcoin arrives at noteworthy lows, addressed by the green box, or generally high qualities, which are seen when the pointer moves into the red box.

Past examples of whenever the Pull Multiple demonstrated great purchasing openings incorporate mid-2018, when the cost of BTC slammed below $4,000 amidst the crypto winter, and again in March 2020 when costs fell because of the Covid-19 pandemic.

It likewise gave merchants a sell signal in late 2017 in light of the fact that the cost of BTC finished out at that cycle’s part, additionally during the Bitcoin market of 2013.

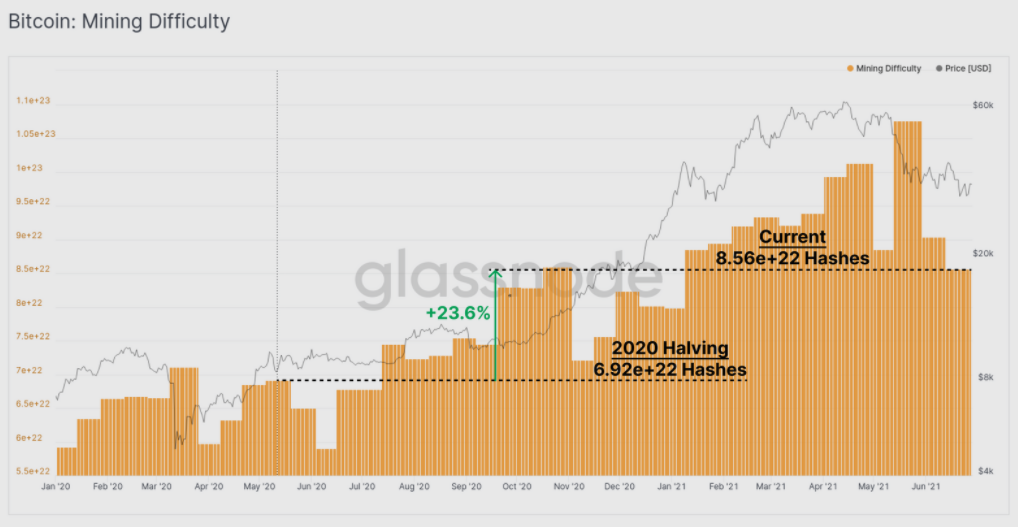

The new battles for Bitcoin are exacerbated by the crackdown on mining in China, which incited various enormous mining homesteads to get together and move to different nations. Examiners currently expect the biggest drop in mining trouble ever as the hash rate plunges from notable highs.

Bitcoin mining trouble. Source: Glassnode

While excavators have commonly seen as necessary venders on account of their had the opportunity to take care of the proper expenses associated with working a mining activity, ongoing selling conduct has been trailed by the half draw-down in cost which implies twice as much BTC should be offered to take care of similar expenses in fiat just as expanded costs caused by diggers moving their tasks out of China.

Related: Iranian exchange service issues 30 crypto mining licenses

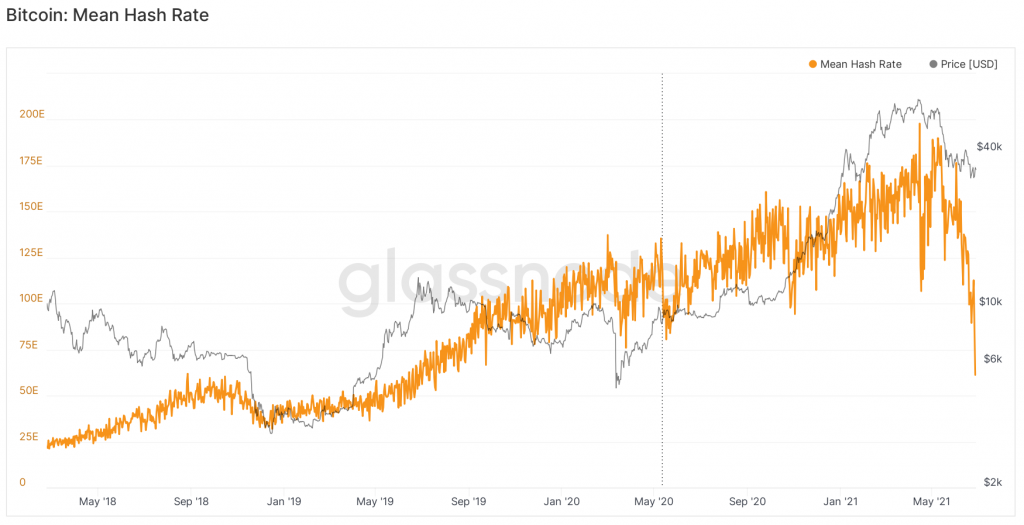

Mindful merchants might be centered around the way that previous cases of critical decreases in hash rate have been trailed by value pull-backs, bringing about a hesitance to send assets in the current economic situations.

Mean Bitcoin hash rate versus cost. Source: Glassnode

While the cost of BTC has made a few additions on June 28, Pull offered an expression of alert that different components ought to be thought of and no marker ought to be utilized in disconnection to settle on exchanging choices.

Pull said:

“Hash rate follows cost AND other exogenous variables, as we’ve unmistakably seen with the China circumstance.”

The perspectives and conclusions communicated here are exclusively those of the creator and don’t really mirror the perspectives on Cointelegraph.com. Each venture and exchanging move implies a hazard, you should direct your own examination when settling on a decision.