Each dealer means to purchase low and sell high, however, a couple can marshal the fortitude to conflict with the group and buy when the downtrend turns around the course.

At the point when costs are falling, the conclusion is negative and dread is at outrageous levels, however, it’s on occasions such as these that the Converse head and shoulders (IHS) example can show up.

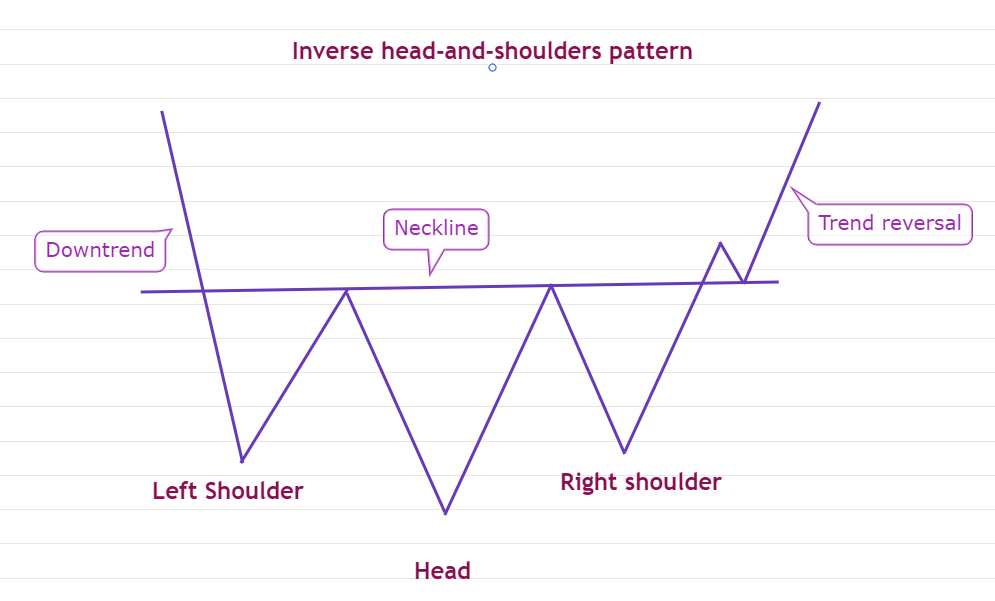

The (IHS) design is comparable in development to the customary H&S top example, however the arrangement is altered. On culmination, the (IHS) design flags a finish of the downtrend and the beginning of another upswing.

Reverse head and shoulder rudiments

The (IHS) design is an inversion arrangement that structures after a downtrend. It has a head, a left shoulder and a right shoulder that are topsy turvy and set under a neck area. A breakout and close over the neck area finishes the arrangement, showing that the downtrend has switched.

As displayed over, the resource is in a downtrend yet after a critical decrease, esteem purchasers accept the cost has arrived at alluring levels and will begin base fishing. At the point when request surpasses supply, the resource shapes the primary box from the left shoulder and the value begins an alleviation rally.

In a downtrend, merchants sell on meetings. The bears sell forcefully after the pullback and the value plunges underneath the main box, making a lower low. In any case, bears can’t benefit from this shortcoming and resume the downtrend. The bulls purchase this plunge and start a help rally, shaping the top of the example. As the cost approaches the past top where the meeting had slowed down, the bears again step in.

That begins the decay, coming full circle in the arrangement of the third box, which is captured practically in accordance with the main box as purchasers expect a turnaround and buy forcefully. This structures the right shoulder of the arrangement. The value turns up and this time, the bulls figure out how to push the cost over the neck area, finishing the example.

The neck area from that point turns into the new floor as brokers purchase the plunge to this help. This signals the beginning of another upturn.

Recognizing another upswing with the (IHS) design

Bitcoin (BTC) had been in a downtrend since shaping a neighborhood top at $13,970 on June 26, 2019. The purchasers stepped in and captured the decrease in the $7,000 to $6,500 support zone, shaping the left shoulder of the (IHS) design. This began a help rally that pushed the cost to $10,450. At this level, momentary bulls booked benefits and bears started short positions, intending to continue the downtrend.

Forceful selling broke the help at $6,500 and the Bitcoin/Tether (USDT) pair plunged to $3,782.13 on March 13, 2020. The bulls saw this fall as a purchasing opportunity and that began a solid help rally, which arrived at near $10,450. This subsequent box framed the top of the arrangement.

The right shoulder was shallow in light of the fact that the selling pressure was diminished and bulls didn’t trust that a more profound revision will purchase. At last, the bulls pushed the cost over the neck area on July 27, finishing the (IHS) design.

The bears attempted to trap the bulls and they pulled the value back to the neck area. Albeit the cost plunged just underneath the neck area, dealers didn’t permit the pair to support beneath $10,000. This recommended an adjustment of conclusion. The bullish energy got as purchasers pushed the cost above $12,500.

Instructions to ascertain the example focus of an IHS arrangement

To figure the base objective goal of the (IHS) design, ascertain the profundity from the neck area to the absolute bottom, shaping the head. In the above model, the neck area is around $10,450, and deducting the absolute bottom at $3,782.13 gives a profundity of $6,667.87.

This worth is then added to the breakout level, which in the above model, is close $10,550. This gives an objective target at $17,217.87. At the point when a pattern changes from down to up, it might miss the mark or surpass the objective goal. Along these lines, dealers should utilize the objective as an aide and not dump their positions on the grounds that the level has been reached.

Persistence pays o in light of the fact that occasionally the example comes up short

No example prevails at each breakout and brokers should trust that the arrangement will finish prior to starting the exchanges. Now and then, the example structure shapes yet the breakout doesn’t occur. Merchants who appropriate the culmination of the example and start exchanges get caught.

For instance, Chainlink’s LINK finished out at $4.58 on June 29, 2019, and began a rectification. The purchasers endeavored to slow down the decrease in the $2.20 to $2.00 zone. This framed an (IHS) design with a head and two shoulders as can be found in the diagram above.

Albeit the cost arrived at the neck area on Aug. 19, 2019, the purchasers couldn’t push the cost above it. Because of this, the example didn’t finish and the purchase signal didn’t trigger.

The LINK/USDT pair diverted down from the neck area and broke underneath the top of the arrangement at $1.96, refuting the example. This caught dealers who might have bought fully expecting a pattern inversion.

Key takeaways

The (IHS) example could be a helpful device for brokers to hop on another upturn as it is beginning. There are a couple of significant focuses to recall while utilizing this arrangement.

Brokers should trust that the example will finish, which occurs after the value breaks and closes over the neck area, prior to starting any long positions. A breakout of the neck area, which is on better than expected volume, is bound to result in another upswing contrasted with a breakout that occurs on low volumes.

At the point when a pattern turns around, it by and large proceeds for quite a while. Thusly, dealers ought not be in a rush to dump positions simply because the example target has been met. At different occasions, the example finishes however rapidly turns around heading and the value plunges. Dealers ought to intently watch different pointers and value activity prior to settling a position.